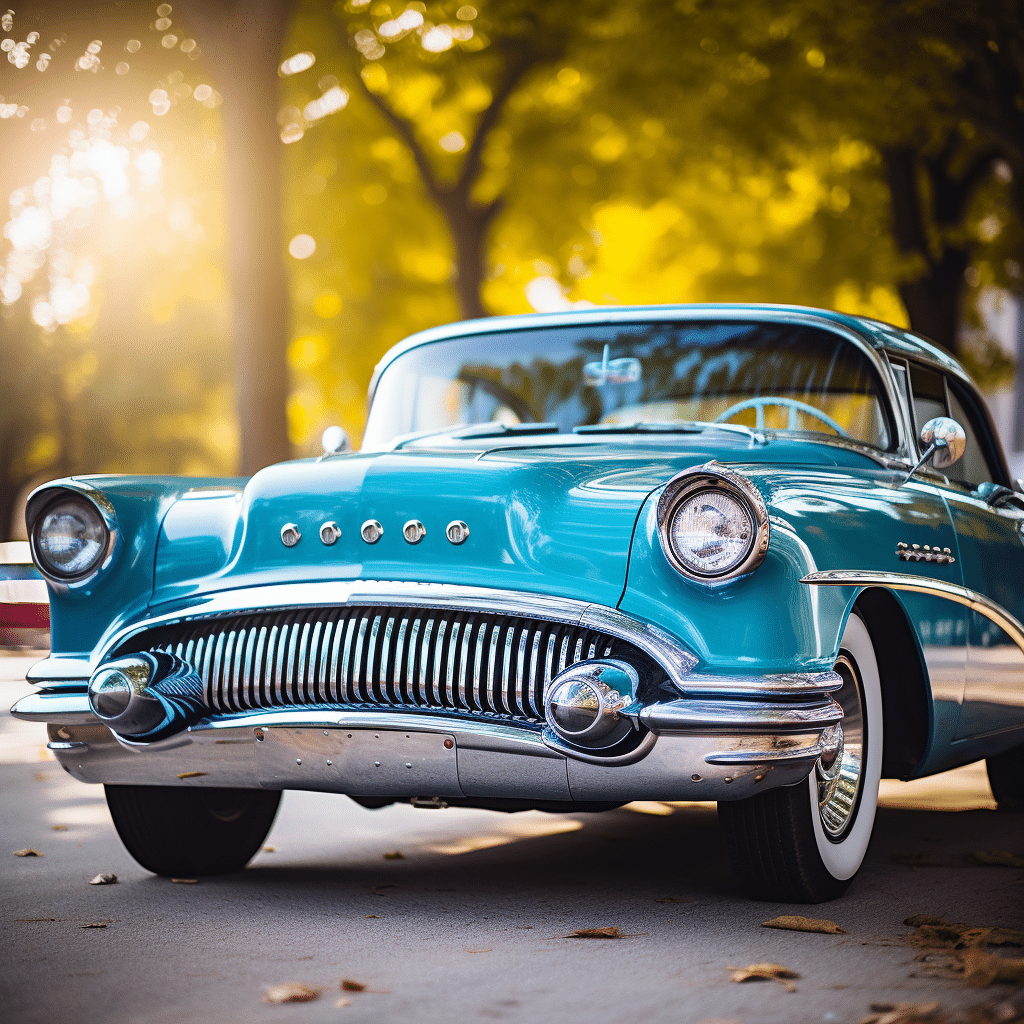

Insuring Classic Cars: Tips for Specialized Coverage

Classic cars have a special place in many people’s hearts. It’s important to insure them, to safeguard their value and provide peace of mind. Whether you own a classic car or are thinking of buying one, it’s essential to learn how to insure it.

Insuring a classic car needs specialized coverage tailored to its unique needs. This is different from regular auto insurance policies. The age, condition, and value of the vehicle all need to be taken into account. If there’s an accident or damage, this ensures you get the right compensation, without devaluing your car.

Look for an insurance provider experienced in vintage vehicles. They will know all the details of insuring classics. They can help you determine the accurate value of your car, based on its make, model, year, and condition.

Choose the right type of coverage. Agreed value coverage sets an agreed-upon amount with the insurer, if your vehicle is a total loss due to theft or irreparable damage. Stated value coverage allows you to specify what you believe your vehicle is worth, but it depreciates over time.

Take measures to secure affordable premiums. Install safety features such as alarms, tracking devices, and immobilizers.

Review and update your classic car insurance policy regularly. If values change due to market conditions or restoration efforts, you need to keep your policy up-to-date.

These tips, plus working with experienced professionals, will help to protect your classic car.

Why insuring a classic car is important

Insuring a classic car is essential for multiple reasons. It offers financial security against accidents or theft. Repairing a vintage automobile can be pricey, so insurance can help with those costs. Also, classic cars may have sentimental worth to their owners, so insurance can give them peace of mind. Lastly, in some regions it may be needed by law to provide safety on the roads.

When securing classic car insurance, certain details require attention. It’s different to regular auto insurance, as it takes into account the car’s age, rarity, and condition. It’s important to accurately assess these factors when deciding what coverage is needed. What’s more, traditional insurers may not understand the true value of a vintage car, so it’s better to look for specialty insurers who do.

Here are some tips for proper coverage:

- Firstly, get an agreed value policy instead of an actual cash value policy. This guarantees an agreed-upon amount with the insurer, depending on the vehicle’s appraised cost, instead of its depreciated worth.

- Secondly, opt for comprehensive coverage that defends against natural disasters & vandalism. Classic cars are commonly stored in special facilities and are more prone to destruction from floods or malicious acts.

- Lastly, join a reliable classic car club or association. Insurers often give discounts to members and it shows responsible ownership. Plus, it gives access to useful resources and expertise to maintain the car.

Steps to insure a classic car

To insure a classic car, you must take a careful approach. This ensures its unique value and condition are properly safeguarded. Here are the steps to secure the right coverage:

- Locate insurers who understand classic car insurance.

- Gather documents such as ownership papers, photos, and maintenance records.

- Evaluate the value using expert appraisers or online resources.

- Compare insurance policies to find one that suits your needs.

- Submit your application with all documents to the insurer.

It’s key to know that classic car insurance might have limits on mileage and usage. Learn about these details prior to making a decision.

An interesting case highlights the need for proper insurance for classic cars. In 2017, a rare vintage Ferrari worth $35 million had an accident at an event in France. Luckily, due to its coverage, the owner got full compensation for the damages. This serves as a reminder of why it’s so important to insure your classic car.

Tips for insuring a classic car

Insuring a classic car needs special attention. Here are some tips to help you out:

- Pick an insurance company that specializes in classic cars. Not all providers offer coverage that suits these vehicles.

- Work out the agreed value of your classic car. Unlike regular cars, classic cars often become more valuable over time. Agreeing on a value with your insurer will make sure you get paid enough if your car is totally lost.

- Keep proper documentation for your classic car. This involves keeping records of any alterations or renovations, as well as regular appraisals to track its value accurately.

- Join a recognized classic car club or organization. Some insurers offer discounts or special benefits for members of these groups.

- Take steps to secure your classic car from theft or damage. This could be investing in a secure storage space, setting up an alarm system, or using a specialized locking device.

It’s worth noting that some insurance policies for classic cars may need certain usage restrictions or mileage restrictions. Knowing and following these requirements can help ensure continuous coverage and prevent any potential disputes.

When insuring a classic car, it’s important to be proactive and thorough. By following these ideas and talking closely with an experienced insurer, you can feel secure knowing that your prized possession is covered if something unexpected happens.

Conclusion

Insuring a classic car? Consider these key factors.

- Get a company specialized in classic cars. They know the unique needs.

- Accurately determine the value of your car. This affects coverage.

- Maintain good storage and security for your car. Reduces risk.

- Be aware of restrictions or limitations on usage with policy.

Pro Tip: Research and compare quotes to get the best coverage at a competitive price.

Frequently Asked Questions

Q: What is classic car insurance?

A: Classic car insurance is a specialized insurance policy designed to protect vintage, antique, and classic cars. It provides coverage that is tailored to the unique needs and value of these types of vehicles.

Q: What qualifies as a classic car?

A: Generally, a classic car is considered to be a vehicle that is at least 20 years old and of historical interest. However, qualifications can vary among insurance providers, so it’s best to check with your insurance company to determine if your car meets their criteria.

Q: How is classic car insurance different from regular auto insurance?

A: Classic car insurance differs from regular auto insurance in several ways. Unlike regular insurance, classic car insurance takes into account the collectible value, rarity, and condition of the vehicle. It may also offer specialized coverage options like agreed value coverage and restoration coverage.

Q: Can I use my classic car for everyday transportation?

A: Most classic car insurance policies have limitations on how the vehicle can be used. They typically require that the car is used on a limited basis, such as for exhibitions, club activities, or pleasure driving, and not for regular commuting or commercial purposes.

Q: How is the value of a classic car determined for insurance purposes?

A: The value of a classic car for insurance purposes can be determined through various methods. These may include appraisals, market research, historical data, and expert opinions. Some insurance companies also offer agreed value coverage, where the insured and the insurer agree on the car’s value at the time of policy inception.

Q: What factors can affect the cost of classic car insurance?

A: Several factors can influence the cost of classic car insurance, including the car’s age, make, model, condition, usage, storage location, the driver’s age and driving history, and the coverage options chosen. It’s advisable to obtain quotes from different insurance companies to compare rates and coverage options.